Bonnie Henry’s Vaccination Mandate Caused Harm to the Municipal Pension Plan

BC Pension Data: At Least 10.8% of the Health Sector was Terminated by the End of 2021

Municipal Pension Plan (MPP)

*** This post concerns a predominantly women-based, very large, unionized, active and retired workforce of 421000+ members in British Columbia: 12% of Registered BC Voters.1 ***

“Membership in the Plan is open to all eligible employees of a municipality, school district, college, health service organization, police and fire fighters, and many other eligible employers as designated by the Board.”2

*** BC nurses are members of the MPP. ***

As of December 31st, 2022, the MPP “may” have 240,549 active members currently contributing, 123,908 retired members not contributing and receiving benefits, and “may” have 57,209 inactive plan members.

Inactive members are employees that have terminated employment, either by resignation or termination. “Inactive members may be eligible for a pension in the future or may become eligible if they return to work for a plan employer where they contribute to the plan and accrue additional service.”

Drop in Employer Contributions Points to Mass Terminations

In a defined benefit plan, like the MPP, employees and employers each contribute a percentage of the regular wages at a given rate. I’ve set up two models, described in Appendix A, to infer active member growth rate from employer contribution data.

From these two models, I can infer that the health sector in British Columbia suffered a massive mass termination event ranging from -10.8% to -13.6% of the workforce. The public sector was inflicted mass terminations ranging from -8.6% to -11.5%. This can only be the result of Bonnie Henry’s covid-19 vaccination policy.

In my previous post, using BC Nurses’ Union membership data, I estimated a lower bound of the nurses’ termination rate of 9.7%, At Least 4762 (9.7%) Missing Nurses Because of the STILL ON-GOING Covid-19 Vaccine Mandates for BC Healthcare Workers.

Two completely different and independent datasets: Union Membership data and Pension Membership data confirm similar drops in membership in 2022 vs. 2021.

Impossible Negative Wage Growth in 2021 and 2022

The financial statements of the MPP discloses:

the annual contribution rate of their members,

the total member contributions, and

the active membership.

With these three inputs, I can infer a yearly aggregate wage growth. I’ve setup two models3 to estimate the yearly wage growth of plan members. I’ll spare you the math and only show a graph.

It looks like this:

Both models convey the same general idea that public employee wages always go up, nothing unexpected and holds true from 2011 to 2020.

It is shocking to see that in 2020, while public service employees were largely working from home, they enjoyed a 6.1% aggregate wage increase.

In 2021 these two wage growth models turn negative to -0.4%. In 2022, they show negative growth rates of -2.3% and -3.6%. Both, implying that wages went down, which is impossible for public service employees.

Of the three inputs used in the wage growth estimates, annual member contributions and member contributions rates are part of the audited financial statements which received a clean audit opinion from the auditor KPMG.

The active membership input is not part of the financial statements and is not audited. This is the most likely parameter that is causing impossible negative wage growth estimates in 2021 and 2022.

These two models of average wage growth over 2011 to 2020 average 3.3% which is spot on the actuarial salary escalation rate of 3.25%4 determined by Eckler, the actuarial firm used by the MPP. In other words, my estimates of implied wage growth find supports with the actuarial assumptions of the MPP.

BC NDP Caused Damages to the MPP with Covid Vaccine Mandate

The mass hidden terminations of members of the MPP are undoubtedly caused by Bonnie Henry’s covid-19 vaccination mandates.

In the next sections, I’ll elaborate on what some of the damages to the MPP are.

Employer Contribution Rate Drop in 2022

The financial statements of the MPP don’t disclose the blended employer contribution rate, but they do disclose the aggregate employer contributions. The financial statements disclose the member contribution rate and the member contributions from which we can infer the payroll. With the payroll and the employer contributions, we can finally infer the employer contribution rate.5

The employer contributions rate dropped from 9.8% down to 8.8%, a 10% drop in the employer contributions rate. This clearly demonstrates one of many financial motives behind the covid-19 vaccination mandates. Except for the health sector still under Bonnie Henry’s quackery, all other public sector employers have rescinded their vaccination mandates.

From 2011 to 2016, the member and employer contribution rates were steadily increasing which, in my opinion, is a fair sharing of the funding of pension liabilities between members and employers.

Come 2017, the BC NDP is in power, and the member contribution rate froze to 8.5% until 2021 while employers absorbed a greater share of the funding needs.

This demonstrates:

the MPP board is not acting independently of politics and for the best interests of the plan.

BC NDP cronyism: veiled public support manipulation and vote buying by giving a member contribution rate increase vacation, courtesy of employer captured unions.

Overstated Active Membership Will Overstate the MPP Surplus

There’s potentially fraudulent overstatement of the reporting of active members of the MPP. In Appendix A, I calculated a range that there’s between -8.6% to -11.5% fewer public sector members in 2022. -10% in active membership is a fair general estimate of the covid-19 mandate non-compliance terminations.

In 2022, the active membership of the MPP was 240549, using the above adjustments, the true active membership is likely between 212993 and 219915, which are active membership levels of mid-2020 if we can trust the previous years active membership figures. This is a two-year setback for the MPP.

When the active membership is overstated, then the present value of future contributions is also overstated, which overstates the MPP actuarial surplus. Here’s the financial statement that is affected by this:

An overstated funding status will mislead the board in the setting of the required member and employer contribution rates for the MPP to remain in a fully funded status. In other words, this is setting up the plan in the wrong direction.

Here’s the text from the financial statements explaining the relationship between the funded status of the plan, which depends on the surplus, and contribution rates:

Damage to the Workforce: Inactive Member Growth More Than Double in 2021 and 2022

I defined inactive member growth as the change of inactive members with respect to the active members. There’s a sharp increase of 2.3% and 2.1% in 2021 and 2022 respectively, compared to the previous ten-year average of 0.8% over 2011 to 2020.

Inactive members are people who have left employment either by resignations or by terminations. The covid-19 vaccine mandate terminated members are still being accounted within the active members of the MPP. Therefore, the 2.3% and 2.1% inactive member growth for 2021 and 2022 is just people resigning or being terminated for other reasons than non-compliance with a vaccination mandate.

The exponential fit curve in orange indicates that people are quitting at a much higher rate in 2021 and 2022 than in pre-covid vaccination mandate period. This is damage to the workforce.

The 2022 inactive member growth and levels are understated because the active member level is overstated by covid-19 vaccine mandate terminated members. By moving the covid-19 vaccine mandate terminated members, still accounted in active membership, over to inactive members, the 2022 inactive member growth rate vs. 2021 active membership is 12.7%.6

Ratio of Active to Retired Members

“… the ratio of active to retired members is slowly getting smaller. This is the result of an aging membership—the retired population is growing faster than the plan’s number of active members. The actuary considers this as part of the plan’s valuation.”7

I’ve created a chart to illustrates how that very important ratio is evolving.

For 2022, I recalculated the active to retired ratio to account for -10% drop in active membership due to covid-10 vaccination mandates. The ratio is 1.7. Including the covid-19 vaccination mandate terminated members in the active membership, artificially overstates the ratio at 1.9.

The ratio of active to retired members is a measure of plan maturity. The lower it is, the more mature the plan is, the less investment risks it can take. This influences the investment opportunities the plan can pursue.

An overstated ratio of active to retired members can misled the investment policy of the plan and cause it to take more investment risks than warranted by its true demographics. It will also misled the actuary in overstating the plan’s valuation.

Covid Vaccine Mandate Terminated Members Negatively Affect MPP Funding

The termination of about 10% of the public service workforce had a negative effect on the funding of the MPP in 2022. The following table shows increase of assets coming from contributions without plan investment returns, decrease of assets from plan benefit payments and the surplus in funding which is the difference between the two.

At the end of the last BC United government in 2016, a modest funding gap appeared, which was made much worse by the following BC NDP government in 2021 and 2022, the vaccine mandate years and still on-going for the health sector.

The following chart shows the ratio of contributions without investment returns vs. benefits paid over years. When it drops below 100%, it means that the shortfall in contributions vs. benefits paid to retired members comes out of the asset base.

This is a graphic representation of the consequences of:

terminating 10% of the members, and

giving a member contributions rate increase vacation (vote buying/union cronyism)

In 2009, contributions covered 110.8% of benefits paid. In 2016 to 2020, contributions covered more than 98% of benefits paid and that’s not something to worry about. But, in 2021 and 2022 a sharp drop in benefit payment coverage from contributions occurred, 96.1% and 89.6% respectively. This is not good and is the consequence of the covid-19 vaccination mandate terminations.

If this situation perdures then the presumption that the MPP can be maintained in perpetuity is to be challenged. In other words, employers may be pressured to terminate the MPP and offer a defined contribution plan instead.

A defined benefit plan like the MPP is very valuable to plan members because it is the employer that absorb their longevity risk (the risk that the pensioner runs out of money before death). In a defined contribution plan, it is the pensioner that absorb his own longevity risk.

Adverse Effects on Actuarial Valuation

An overstated active membership will affect the:

demographics assumptions used by the actuary, Eckler Ltd.

actuarial valuation of accrued pension obligations which determine whether the MPP is adequately funded or not.

All this is likely to cause the actuary, Eckler Ltd., to issue recommendations based on unreliable data which will mislead the board of the MPP.

An overstated active membership adversely affect all the important decision making of the MPP such as setting appropriate contribution rates, the investment policy of the plan such as risk tolerance and return objectives, choices of investment opportunity, etc.

Inevitably, the reality of the mass termination will have to be acknowledged and the MPP board will have to change its funding policy to significantly increase the contribution rates of both employees and employers.

Eventually the economics of maintaining the presumption of the MPP operating in perpetuity will be challenged. Active members will have to face an unexpected steep contribution rate increase, or pension inflation adjustments which is funded by surpluses will have to go. The financial surplus of the MPP dropped from $14.7B, in 2021, to $8.4B. in 2022. A 42.9% drop in financial surplus.

The Inflation Adjustment Account is funded by the surplus which pays for cost-of-living-adjustments (COLAs).

Bye-bye non-guaranteed future COLAs; That’s damage to the MPP and to the interest of their members. Retirees and current members are at an increasing risk of only getting a basic guaranteed pension, inadequately adjusted for inflation. The pensioners purchasing power is at risk from the BC NDP covid-19 vaccination mandate still affecting the health sector.

The Motives of the BC NDP

Carl Jung said: “if you can’t understand someone’s actions, you have to look at the consequences and infer the motive.” The BC NDP covid-19 vaccination mandates were never about public health. Ulterior motives, lack of good faith, are in play.

Closeted Misogyny

1. The BC NDP fired at least 9.7% of BC Nurses which are predominantly 90% women.

2. The BC NDP financially abused older rich women by coaxing them into bequeathing to their corrupt and rotten-to-the-core party.

3. And now, the BC NDP caused harm to the MPP, the pension fund of an active and retired workforce composed of 73% women.

It is conclusive that the BC NDP is targeting mostly women pensioners and has no regards for those who raise and care for the next and also previous generation. The numerical facts, backed by hard data, clearly show that the BC NDP is harming women. So, I’ll channel my inner Trudeau and say that the BC NDP became a fringe party that has closeted misogynistic views of women. The pinnacle of hypocrisy for an organization purporting to be committed to social justice.

Money - Ghost Employee Fraud Scheme

Another motive for the BC NDP covid-19 vaccination mandate is the short-term benefit of embezzling 10% of the government’s payroll by effecting fake terminations under the false pretense of public health and diverting that payroll to finance other ideologies.

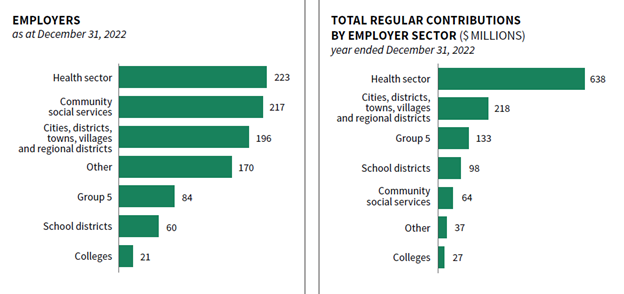

On the member side, the MPP financial statements report that contributions increased by 3.3% in 2022. On the employer side, contributions decreased by -11.6% to -8.5% in 2022.

Employee and employer contributions moving in opposite directions is impossible because employees and employers both have positive contribution rates. What best explains these dissonant conclusions is the presence of ghost employees across the public sector.

A ghost employee is a fake employee on a payroll who doesn’t receive a paycheck. A ghost employee scheme is a fraud scheme where a corrupt payroll administrator creates fake employee records or doesn’t remove terminated employees from the payroll and in both cases will redirect paychecks somewhere else.

In the case of the BC Government, it’s not paycheques that are redirected somewhere else but a substantial fraction to the payroll budget corresponding to the terminated employees.

In the case of the covid-19 vaccine mandated public sector, the non-compliant employees may not have been completely removed from the payroll, instead the employer simply communicated that they were fired where in fact, they were not. This explains why the active membership of the MPP is significantly overstated in 2022.

Conclusion

Let there be no doubt that the BC NDP is acting against the interests of the members of the MPP which covers 971 public employers’ workplaces across BC and 421000+ members. The MPP members need to reconsider seriously their support to the BC NDP and their representation by their union delegates on the board of trustees of the MPP.

Based on 3,524,812 registered voters in 2020. - P.6. October 24, 2020 Provincial General Elections – Report of the Chief Electoral Officer.

Model #1 is (Active Member Growth Factor) x (Wage Growth) = Member Contributions Growth; which uses only yearly member counts and member contributions as inputs.

Model #2 is Avg Salary Growth between over two consecutive years. Where Avg Salary = Member Contributions / Contribution Rate / Member Count. Uses member counts, member contributions rate and member contributions as input.

1 - Member Contributions / Member Contribution rate = Payroll

2 – Employer Contributions / Payroll = Employer Blended Contribution Rate

If I take the difference between the 2022 active membership of the MPP of 240549 and the mid-point of 212993 and 219915 (216454), I can adjust the 2022 inactive membership from 57209 to 81304. (81304 – 52332) / 227493 (2021 active membership) = 12.7% growth in inactive members in 2022.

No justice for now. BC is under communism government.

I was one of the members now fired under mandate. Still mandating to me as a healthcare worker in hospital. Every day is struggle. Dr. Bonnie Henry and NDP ruined my life