Investing in the Lumber Industry for the Truth and Freedom Loving Investors

Paid Lumber Duties Held in Trust by the US Department of Commerce is an Undervalued Embedded Binary Option

I want to pause from writing about covid and corruption stories and move into what I really love to do and what I’m trained for and experienced in: investment research and analysis. I’ll be addressing investing issues for the freedom-loving public who has a clue and an appreciation for what’s really going on in the world.

If investing doesn’t interests you, please don’t unsubscribe, I still have more stories to come about covid, government corruption and politics. I will let my readers know if I decide to go 100% into investing only topics.

Most long-term investment returns can generally be attributed to strategic asset allocation, top-bottom approach. Combining a top-bottom approach with single stock picking, a bottom-up approach, allows to express strategic asset allocation in a manner suitable to individual investor return objectives and risk tolerance.

I like industries that produce a solution to a real human need that will always be there regardless of economic conditions. Housing and building stuff with wood products is a good example.

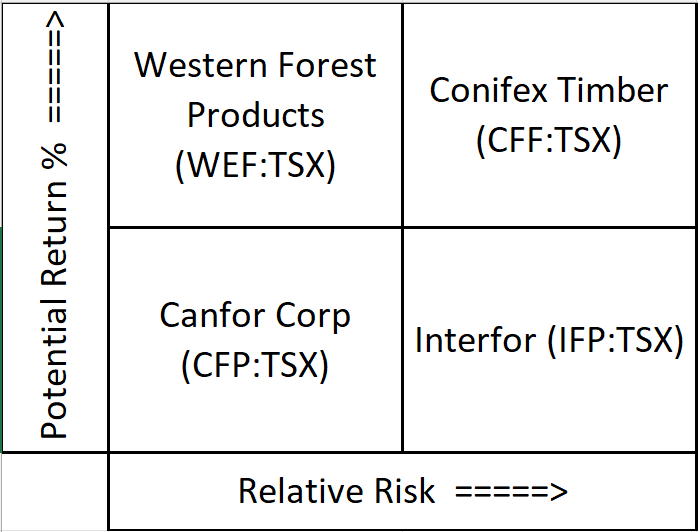

I’ve reviewed four wood products companies that are investable:

The above companies have a low Price/Book ratio; indicating that, barring asset impairments, they are trading at pennies on the dollar from liquidation value. They have a very low Net Debt/Equity Ratio which provides a strong margin-of-safety; They can pay off any little debt they have, and shareholders are not much at risk from debt default.

These companies are most likely closer to the bottom rather than the top of their cycle. Unless society stops build houses, these lumber companies will eventually benefit from improving economic conditions. They have more upside than downside. The investment time horizon would be around 3 to 5 years as favorable economic conditions reach a peak.

These are small- and mid-capitalization companies which tends to outperform large caps. When economic conditions become favorable, it is the smallest companies that have the greatest and fastest valuation adjustments.

Capital markets are forward-looking pricing mechanism of economic information. The lumber industry is not heavily covered by Bay Street analysts which is a good thing for the savvy retail investor because there are more information pricing inefficiencies to take advantage of.

I did review the financial statements of these companies and I noted the presence of unqualified audit opinion, which is good. But their audit opinion is also accompanied with Key Audit Matters which is essentially the auditor inviting the investor to pay particular attention to areas of the financial statements relying heavily on the judgement of management. This is a situation that reminds investors of the importance of a strong tone-at-the-top.1 Without a deep-dive understanding of these Key Audit matters, I would wait until the next annual reports are released to see the Key Audit Matters disappear before buying.

Another interesting point these lumber companies have is an embedded option in the form of paid anti-dumping and countervailing duties held in trust at the US Department of Commerce. These paid duties, in amounts commensurate with the market capitalization of these lumber companies, are being challenged and could potentially be refunded which would generate some unexpected significant returns.23

These companies are also buying back their stocks. Share buybacks are equivalent to a tax-free dividend for the remaining shareholders.

Outlook of the Lumber Industry from Management’s Perspective

I reviewed the economic Outlook discussed in the financial statements of these lumber companies to highlight what Management think is coming and summarized it as follow with details in these footnotes. 4567

Overall, lumber company Managements are not expecting the lumber markets to increase significantly in the short-term (within the next months to a year), in the long-term there are good market fundamentals supporting sustained demand coming from house repairs and an aging housing inventory.

You can qualitatively assess the peak and bottom of the industry by identifying the specific economic conditions that drive demand for wood products. The key data to monitor to successfully invest in these lumber companies are:

The effect of inflation and interest rates on consumer spending

US housing completion, repair, and remodelling activity

Mortgage rates

Geopolitical tensions

Supply of existing home inventories

Labour shortages

Advanced age of US housing stock

Shortage of available housing

US housing starts

Benchmark Western Spruce/Pine/Fir (“WSPF”) prices

Home centres’, like Home Depot and Lowes, Same Store Sales Growth

A good way to time an investment in these lumber companies would be to:

Look for a reasonable expectation of peaking inflation, interest, and mortgage rates as a signal favorable to lumber demand.

Monitor same-store-sales growth of home center companies, like Home Depot and Lowes, and the Outlook commentaries of US homebuilding companies.

Key Observations

All four companies have repurchased their shares in 2022 at price levels much higher than now. This is a unanimous expression that the industry is significantly undervalued.

Conifex (CFF:TSX)

Conifex repurchased shares at $1.19 in Q2 2023 and at $1.80 in 2022. Shares are currently trading in the $0.6 to $0.7 range.

Most of its decreasing debt is non-recourse to its lumber operations and tied to its bioenergy segment.

Diversified Sales: USA (58%), Canada (38%), Japan (4%).

I suspect that Conifex is an awake company; Every publicly listed company must document its risk factors. These are conditions that affect the financial position (balance sheet) and performance (income and cash flow statements) of a company.

In pre-covid years, Conifex had a risk factor heading called “natural disasters”.8 Right after the covid pandemic declaration, Conifex changed that risk factor heading to “natural and human-made disasters and climate change”.9 This is not a coincidence. I suspect Conifex’s Management is likely awake and understands the uncanny causes of covid pandemic and unprecedented BC forest fires and strange fire management responses.

Western Forest Products (WEF:TSX)

I reviewed its 58 pages August 2023 Investor Presentation. The first off-putting 20 pages is ESG content (the children section); It gives good conscience to the woke investors and fund managers that need to show ESG in their portfolios. The investment merits (the adult section) start at p. 21: Company Snapshot Sustainably Growing and Creating Long-Term shareholder Value.

Pays a quarterly dividend and has renewed its share buyback program in 2023.

In 2022, it repurchased its shares at an average of $1.67. Shares are currently trading at in the $0.70-$0.80 range.

Diversified Sales: Canada (28%), USA (36%), and International (36%).

58% of its sales is specialty lumber, that brings a premium to a commodity.

Has negligible intangible assets, which have a tendency to be written off in adverse economic conditions.

Growing capital investments which are a source of future returns.

Its ESG data is dated from 2020, 2021, nothing from 2022, and we’re at the end of 2023. It would be a good sign if, in its 2023 annual disclosures, it doesn’t update ESG data, that would signal that they are abandoning that non-sense.

Its $250M borrowing facility shows the effect of the bankers trying to drive in ESG with a 0.05% interest discount if certain “sustainability” goals are reached. It’s not material to investors, it’s just ESG window dressing.

It provides informative and relevant statistics on US Repair & remodelling expenditures projected to increase, and home centres, like Home Depot and Lowes, Same Store Sales Growth. Various specialty commodity price indices, Housing Starts projected to bottom in 2023-2024 and trend upward after.

Price/book ratio at a 10-year low, representing deep value.

Overall, Western Forest Products is a very investable company. It presents itself very well in a compelling manner and is even guiding the investor to what economic conditions to monitor to successfully invest in it with confidence.

Interfor Corporation (IFP:TSX)

I reviewed Interfor’s November 2023 investor presentation and financial statements.

In 2022, Interfor repurchased shares at $37.6 and $29.80. Stock is currently around $20-$21.10

Sales mostly to USA (84%) and Canada (14%), Abroad (2%).

85% of 2022 revenues from softwood lumber: pure-play

Price/book ratio at 10-year low, representing deep value.11

Operating Cash Flows still positive despite challenging industry.

Demand for its products is 32% New Home Construction, 30% Industrial/Commercial and 38% Repair and Remodelling.

Median Age of US Housing Stock is about 42 years old and will drive repair and remodelling demand.

Aspirational goal to transform into THE major global lumber producer; expect more acquisitions of sawmills.12

Major Capital Expenditures investments in 2022; Capital expenditures are a source of future returns.

Investing in Interfor is like investing in a continuously pruned competitive portfolio of sawmills.13

Canfor (CFP:TSX)

Canfor repurchased its share at $23.70 in 2022, currently trading at $14.90.

Increasing assets and decreasing liabilities which shows in a risk reduction trajectory.

Its sales are product diversified with pulp and paper products (14.6%) and lumber (85.4%) in 2022. Sales diversification by location, Canada (11%), USA (55%), Europe (17%), Asia (15%), Other (2%).

13% of assets are intangibles, if management has a strong tone-at-the-top, this shouldn’t be too much of a concern.

Operating cash flows are still positive in a somewhat challenged industry.

What I like about Canfor is that their annual reports are very detailed and offer additional forward-looking insights into the industry compared to CFF and WEF.

The Jim Pattison Group is Canfor’s largest shareholder with an interest of 52.6%. I have no opinion on the Jim Patteson Group, but I do have the opinion that for any company, when there’s a significant shareholder, there’s often opportunities to abuse minority shareholders. The interests of minority and large controlling shareholders are not always aligned.

John R. Baird is a director of Canfor. Freedom-loving people may have legitimate issues with that. Any potential association with the World Economic Forum (WEF) is cause for concern. However, it’s not because a public figure takes a selfie with a criminal that he is one. Going to one event, doesn’t mean to you agree with the group ethos of the event. However, if someone is seen repeatedly visiting a brothel, then we can safety assume that he’s a “john”. Trudeau and Freeland are well-known visitors of the WEF… Be level-headed, before condemning John Baird for having appeared on the WEF website, it’s important to determine if he currently embraces the WEF ideologies which I have no opinion on. Baird’s link to the WEF website has been removed, suggesting that Baird doesn’t want to have anything to do with the WEF. Several public figures have since woken up and had their WEF profile or link removed from the WEF.

Canfor “Plans” to invest $250M in carbon reduction project by 2030. To me, any significant business decision based on carbon and climate change considerations is a misallocation of capital and misused of shareholder resources. Every year, many people also “plan” to stop smoking, eating less junk food, etc. Since its only a plan, I can only hope that Canfor announced it with the same sincerity of a politician’s campaign promise. Spending shareholder resources without a clear value-based benefit accruing to shareholders is a sin. On the other hand, “cost reductions and efficiency initiatives” of the same order would be totally welcomed.

Canfor’s ESG sustainability reports are a head-scratcher. They are definitely not comparable year-over-year. In 2022, the sustainability report is 26% smaller, page-wise. The ESG non-sense grappling the corporate world seem to have peaked at Canfor. We may be returning to reasonable economics.

It looks like Canfor it reducing its attention to ESG which is a good thing.

Canfor is the largest and most geographically diversified company that I short-listed with no significant debt. Its’ in the mid-cap category. It’s self-financing, it has little need of the capital markets. It’s the least risky of the four short-listed and a very investable company.

Closing Words

In this post, I’m merely pointing to attractive value plays to answer “what” to invest in. I’ve only hinted at the “when” and “how” to invest in these companies which requires a more in-depth analysis. When finding an attractive investment, there’s a great source of return in knowing how to wait for the right time to buy and sell. If anyone wishes a more in depth look into this, I could spend more time and put out a research report as a paid article. My linkedin profile has my contact information and credentials for this kind of work.

I would probably highlight fundamental developments to monitor rather than stock price levels, list macro indicators that would sensibly indicates favorable economic conditions.

Having a strategy informing on how to wait can extract significant value-based returns as well as reducing risks of loss.

In my opinion, the next year is a good opportunity to accumulate a position in these lumber companies. You just need to pick the one that is most suitable to your personal risk return objectives.

If investing in the Canadian lumber industry fits your personal risk and return objectives, the chart below can help you narrow and choose from one of these companies discussed in this post.

ESG is an ideological parasite plaguing the corporate world. ESG is shareholder value destructive because it pursues emotional ideologies that result in misallocated capital. Go Woke, Go Broke. For now, it’s hard to avoid. But by comparing the ESG disclosures of a company with its peers and its own previous disclosures, we can get a sense of whether the company is resisting it or not. I believe at least one third of people, after hearing the Covid alarms bells, have woken up to the reality of The Swamp and corrupt ideologies. These awake freedom-loving people have day jobs in corporations and are inevitably driving corporate resistance to the ESG ideologies and fads.

P. 20 - CONIFEX TIMBER INC. ANNUAL INFORMATION FORM For the year ended December 31, 2022 “To our knowledge, we are accumulating softwood lumber deposits at a faster rate than any other public company, and potentially refundable duties now represent a greater portion of our equity market capitalization than they do for any other publicly traded company.”

P. 31 - Western Forest Products – Investor Presentation August 2023 - $209.4M CAD Duties on deposit with US Dept. Commerce – represents 69% of market cap as of August 18th, 2023.

P. 12 - CONIFEX TIMBER INC. SECOND QUARTER 2023 MANAGEMENT'S DISCUSSION AND ANALYSIS “We expect lumber markets to continue to experience weakness through the remainder of 2023 as global market conditions continue to evolve. The effect of inflationary pressures and higher interest rates affecting consumer spending in the housing and repairs and remodeling markets have resulted in weaker lumber market prices than seen in recent years and is expected to persist through the remainder of the year. While lagging US housing completions and tempered repair and remodeling activity, as well as elevated levels of offshore lumber imports have affected market demand for lumber products, demand and market prices are expected to see a gradual increase in the second half of 2023.”

P. 11 – Western Forest Products - Western Forest Products Inc. 2023 Second Quarter Report “Near-term we expect lumber markets to remain volatile, as consumers adjust to higher interest rates and macroeconomic conditions and lumber supply and demand rebalances. Demand and prices for Cedar timber and premium appearance products are expected to remain strong, while Cedar decking, trim and fencing products are expected to remain weaker. In Japan, channel inventories have rebalanced, however prices are expected to have downward pressure as competition remains strong from Europe and domestic manufacturers. Demand for our Industrial lumber products will be product line specific but are expected to remain stable over the near-term. While North American demand and prices for our commodity products have improved recently, we expect conditions to remain volatile and may take incremental operational downtime to match production to market demand.”

P. 3 - Interfor Corporation Third Quarter Report For the three and nine months ended September 30, 2023 “North American lumber markets over the near term are expected to remain volatile as the economy continues to adjust to inflationary pressures, elevated interest rates, labour shortages and geo-political uncertainty. Interfor expects that over the mid-term, lumber markets will continue to benefit from favourable underlying supply and demand fundamentals. Positive demand factors include the advanced age of the U.S. housing stock, a shortage of available housing and various demographic factors, while growth in lumber supply is expected to be limited by extended capital project completion and ramp-up timelines, labour availability and constrained global fibre availability.”

P. 19 – Canfor Q3 2023 Report “Lumber - Looking ahead, although longer-term lumber market fundamentals remain positive, affordability constraints are anticipated to continue to weigh on demand in the near to mid-term. High mortgage rates, persistent inflation and geopolitical tensions are forecast to exert pressure on new home construction activity through the balance of the year and into 2024. On the positive side, persistent underlying demand for housing in North America, coupled with low supply of existing home inventories, are projected to support the housing sector in the long-term. In the repair and remodeling segment, demand is anticipated to be muted through the fourth quarter of 2023 due to affordability constraints combined with seasonal factors.

Offshore lumber demand in Japan is projected to remain somewhat muted through the balance of 2023, reflecting general economic uncertainty and a slowed housing market. The same demand trend is anticipated for China, despite the introduction of government stimulus measures mid-year. Pricing to China, however, is estimated to improve slightly in the coming months, due to reduced European imports and a continued draw-down of inventories in that region.

European lumber pricing is forecast to face downward pressure through the fourth quarter of 2023 driven mainly by low levels of residential construction activity, moderated to a degree, by continued strength in the do-it-yourself space.

Looking forward from an operational perspective, there remains significant uncertainty with regards to the availability of economically viable fibre in BC. This uncertainty is driven by recent wildfire events, combined with the lasting impacts of the Mountain Pine Beetle epidemic, uncertainties associated with unsettled land and title claims by various Indigenous Nations and outstanding policy, land use decisions and legislative initiatives by the BC Government. While the Company has taken a number of actions in recent years in response to these fibre constraints, the near-term outlook in BC remains challenging. As a result, the Company continues to anticipate sustained log cost pressures in BC for its sawmills and a challenging fibre supply environment for CPPI’s pulp mills (both for sawmill residual chips and whole-log chips). With these continued log cost pressures and the projected weaker North American lumber market demand and pricing, the Company will continue to adjust operating rates to align with demand and economically available timber supply.”