BC Regional Districts Case Study – Regional District of Central Kootenay

Regional District of Central Kootenay Treats Property Owners Like ATMs

The purpose of this financial research and analysis exercise into the Regional District of Central Kootenay (RDCK) of British Columbia is to support grassroot initiatives in aligning the management of the RDCK with the reality of its constituents and to awaken people to the financial abuses and mismanagement committed by local governments. What’s discussed in this post you’ll find in many other local governments therefore this opinion post is for anyone trying to improve local governments.

The findings below are likely to partly apply to many of the other 26 regional districts of B.C.12 Key findings are that the RDCK financial management:

is disconnected from economic realities,

is operating on a for-profit purpose,

is significantly over-taxing property owners,

is over-charging user fees,

has accumulated a massive cash hoard,

has inadequate budgeting practices (reckless budgetary slack),

has a payroll out-of-control.

RDCK Statistics - 2009 to 2022

The RDCK is financially abusing its residents by increasing expenses faster than their capacity to pay for it. “The purposes of a regional district include taking care of the region's public assets and fostering the current and future economic, social and environmental well-being of the region.”3

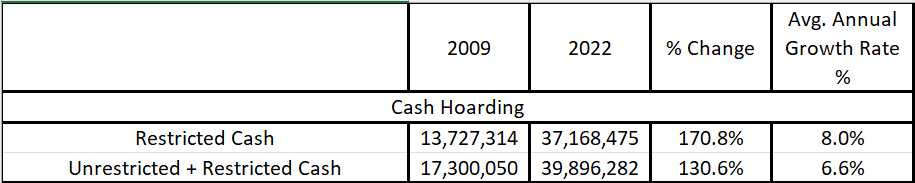

If Total Revenues grow at a rate of 3.9% and Total Expenses grow at a rate of 4.7%, while RDCK’s debt is stable and not excessive. How come the cash balances are increasing at an annual rate of 6.6%?

The Needs of RDCK Residents for Services is Stable

From Statistics Canada, the population of the RDCK is estimated at 57404 and at 63125 in 2009 and 2022 respectively. This reflects modest population annual growth rate of 0.73%. The number of dwellings occupied by usual residents of the RDCK is estimated at 24978 and at 28208 in 2009 and 2022 respectively.4567 This reflects modest dwelling annual growth rate of 0.94%. The blended growth rate of the population and dwellings is 0.84%.

Unsustainable Financial Mismanagement

The average hourly wage rate in BC was $23.93 and $32.57 in 2009 and 2022 respectively. This reflects an annual wage growth rate of 2.4%.

The expenses for the RDCK were $31.3M and 56.9M in 2009 and 2022 respectively. This reflects an annual expenses growth rate of 4.7%. The average annual growth of taxation and user fee revenues over the same period was 4.59% and 4.81% averaging exactly 4.7%.

Expenses are clearly driving property taxes and user fees revenues in an unsustainable manner. This is not aligned with the economic reality of the residents.

RDCK Is Operating on a For-Profit Basis

The RDCK is consistently turning an excessive surplus. This is not an appropriate behavior and is abusing the tax base and residents.

Although that consistently turning a surplus might seem like a good thing, in this case it’s not because it means that an excessive wealth transfer in relation to local needs is happening from the property owners and residents to the RDCK.

The entities benefitting from this wealth transfer are the aggregate runaway payroll and a web of contractors. This is a financial cancer and a local swamp. Financial statements from 2009 to 2022 are available in footnotes.891011121314151617181920

A taxing authority should operate only for the purpose of providing for the common needs of people sharing a common interest, not for entrenched interests and profiteering.

Analysis of the Accumulated Surplus Shows Cash Hoarding

The accumulated surplus is broken down in three categories: Equity in tangible assets, restricted and unrestricted cash. The profiteering and self-enrichment of the RDCK is hoarded in restricted reserve funds. “Reserve funds represent funds set aside by bylaw or board resolution for specific purposes.” The RDCK’s board of directors is fully responsible for cash hoarding excessive surpluses.

Accumulation of restricted cash demonstrates poor budgeting practices causing overtaxing. Restricted Cash Balances grew at an annual compound rate of 8% per year from 2009 to 2022. This is directly the result of poor budgeting practices and a clear proof that RDCK property owners and residents are overcharged for taxation and user fees.

Community Works Reserve X102 service – $9.3M Slush Fund

Financial statements for 2021 contain a detailed per service attribution of restricted cash. Most RDCK services are denoted using S###. There’s a special “Community Works Reserve” service denoted ‘X102’. This special service has $9.3M of the total $32M of restricted funds in 2021.

“Community Works” is also an unbudgeted revenue and expense line item in statement of operations since 2016. The RDCK surplus in 2021 was $6.9M and $2.8M of it was contributed to the “Community Works Reserve” service X102. This screams of “slush fund”.

In 2021, while the surplus is $6.9M, $7.7M ($0.8M more than the surplus) was contributed to restricted funds, $2.8M went to Community Works Reserve – X102, the rest was squirreled in other services.

The Immediate Remedy is a 15% Cut in Taxation and User Fees

Using the 13 years of financial reporting statements of the RDCK. I found that reducing taxation and user fees by 15% would produce a breakeven between revenues and expenses. This calculation was done while leaving the other non-taxation and non-user fees historical revenues sources and expenses as-is.

The rightmost column shows that historical revenues adjusted to factor in a -15% taxation and user fee cut would produce a breakeven accumulated surplus, the result of adequate budgeting, over 2009 to 2022 which is fairer to residents of the RDCK.

The Adj Surplus column = Adj Revenues (-15%) - Historical Expenses. Sum up the Adj Surplus column to obtain an Accumulated Surplus of $42,947, which is practically breakeven in relation to RDCK’s finances.

This 15% cut resulting in breakeven doesn’t even factor expenses reduction, thus it’s really a minimum cut. With better financial management and budgeting, the RDCK would most likely achieve a much higher tax cut.

RDCK’s Budgeting Process is Flawed

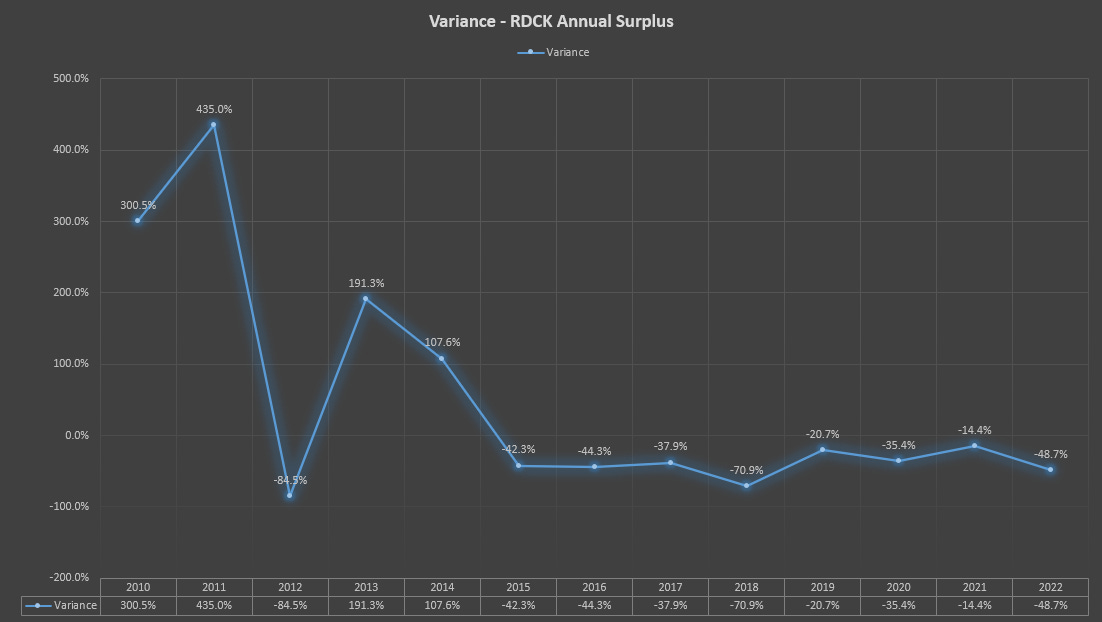

The budget surplus is the forecasted total revenues minus total planned expenses. The budget variance is the percentage between the budgeted item vs. the actual item. The greater the variance, the more inadequate the budgeting process is. Unfavorable budget variance is when the actual performance is worst than anticipated.

A +/-10% budget variance is typically acceptable. Anything beyond that requires an investigation into the budgeting process and operations of the organization.

Large budget variances are caused by changes in planned activities, planned activities not occurring, or errors and omissions.

A History of Large Budgetary Slack

Budgetary slack is the difference between a budgeted and actual financial amount. Excessive budget slack is when there’s a deliberate under-, or over-estimation of revenues and expenses to create a cushion in the budget to game financial performance, presentation, or decision making.

Budget slack is like a benchmark that is manipulated to show favorable outcomes without any real financial management skill applied. By creating a cushion in the budget surplus, financial administrators can spend more than what is needed. This explains why expenses are growing faster than the economics of the RDCK.

The following chart shows RDCK’s history of excessive budget slack. Note that there’s not a single year between 2009 and 2022 that has a budget surplus variance within 10%.

Except for 2012, the years 2009 to 2014 have excessive positive budget surplus variance ranging from -84.5% to 435% and the years 2015 to 2022 have consistently negative budget surplus variance ranging from -70.9% to -14.4%; Total budget failure.

Consistent budgetary slack, whether negative or positive, is a hard proof for lack of financial and operational discipline. Especially when the underlying operations and services have stable and predictable economics like the RDCK. There’s no excuse for that much slack.

Budgetary slack can be used for unethical purposes such as covering up for poor performance, lack of skill, incompetence, embezzlement of resources, cronyism, conflict of interests, corruption, etc. It’s a cover for sub-optimal financial management.

RDCK budgetary slack results in financial harm to RDCK property owners via excessive taxation and to users of services via excessive user fees.

Cause of RDCK’s Budgetary Slack: Financial Morphine

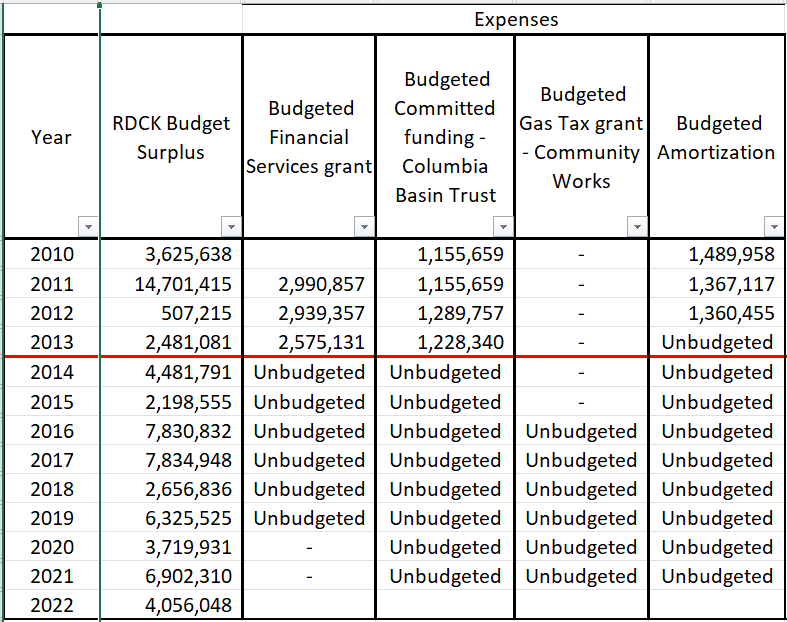

Here’s a grid of large unbudgeted expense items per year and the resulting large budget surplus. Note the time when this practice started: 2014.

The RDCK’s financial managers purposely understated the total budgeted expenses to create a higher projected budget surplus which may corrupt financial decision making. Budget surplus is manipulated by not budgeting for financial services grants, committed Funding – Columbia Basin Trust, Gas Tax Grant – Community Works, and Amortization expenses. This is not an honest budgeting practice. Amortization expense is the spreading over time of the useful life of capital expenses. If amortization is not budgeted, then large capital expenditures are at the whims of diverging interests to the residents.

The omission in the budget of large expense items that are in aggregate greater than the surplus budget is a cunning mechanism.

Seeing projected surpluses, the board may be tricked into not applying too much scrutiny and common sense skepticism into the budget and rubberstamps it, blindly accepting too many services, projects, and the ensuing taxation. The ensuing swindled inflated taxation then generates higher then needed revenues whose effect more than offsets understated expenses. That’s how the RDCK ends up with consistently higher than projected surpluses that are hoarded into restricted funds.

Large projected budget surpluses act like a high dose of financial morphine on the board and renders it ineffective.

This practice of not budgeting large expenses coincides with a change of Chief Administration Officer in 2014. Here’s the history of RDCK’s Chief Administration Officer (CAO) and Chief Financial Officer (CFO) according to SOFIs (Statement of Financial Information). RDCK’s SOFIs from 2012 to 2022 are available in footnotes.2122232425262728293031

RDCK’s financial managers and/or the board of directors are unable to budget in the best interests of residents. If the board doesn’t admit to inadequate budgeting and doesn’t remedy it, then the board is ineffective in its oversight and must be replaced.

Payroll Issues

Out-Of-Control Bureaucracy

These amounts are taken from the annual financial statements.

SOFIs – Statement of Financial Information

“All local governments must prepare an annual statement of financial information in accordance with the Financial Information Act. The statement of financial information must be made available for public viewing by June 30 each year and be accessible for the following three years.”32

Red flag #1 – Excessive Payroll Growth

According to RDCK’s SOFI statements, in 2012, there were 17 RDCK employees earning more than $75000 per year, totaling: $1.6M in wages. Ten years later in 2022, there were 57 RDCK employees earning more than $75000 per year, totaling: $5.5M in wages.

Red Flag #2 – Inconsistent Headcount Growth with Base Renumeration Growth

From 2018 to 2020, headcount decreased, while renumeration increased. This means there were fewer people working getting a greater share of the pie. If headcount is decreasing, you’d expect renumeration paid to decrease too, but that’s not the case.

Red Flag #3 – Inconsistent Reconciliation of Wages and Employee Benefits

The Financial Information Act requires RDCK to reconcile total renumeration with their operation statement (revenues and expenses). That reconciliation is expressed in a SOFI Schedule of Renumeration and Expenses form 6(2)(d) Payroll Reconciliation to Financial Statement.

Reconciling means to explain differences between two financial records by adding and subtracting adjustments. The two records being reconciled are “Wages and Employee Benefits” expense on the financial statement of the RDCK and “Total Renumeration” on the SOFI.

Column A is the Wages and Employee Benefits expense as stated on RDCK’s annual financial statements.

Column B is the “transcribed” Wages and Employee Benefits expense to the SOFI as stated on RDCK’s annual financial statements. It is the starting point of the reconciliation of payroll to financial statement.

Column C is the Total Renumeration stated on SOFI.

Column D is the sum of reconciling items to explain the difference between B and C.

Back to reconciling (explaining differences between related records), Wages and Employee Benefits (B) minus Total Renumeration (C) = Reconciling Items (D). Here are the key observations:

Wages and Employee Benefits expense from the financial statements should always be greater than renumeration because it includes other items such as employer benefits, staff expenses, etc. That’s what those reconciling items are.

Note that from 2012 to 2015, the reconciling items are positive, then in from 2016 to 2021, they turn negative. That’s not supposed to happen. Employer benefits are about 80% of reconciling items in 2012-2013. Employer Benefits certainly didn’t go negative in years 2016 to 2021. The reconciling items in 2016 to 2021 may be the result of forced or corrupt entries.

In column B, from 2016 to 2022, the wages and benefit reconciliation doesn’t start with the correct Wages and Benefits expense, instead it starts with a number that does not come from the financial statements. It’s another made-up number.

In 2022, there’s a massive $5.15M entry to reconcile $17.7M of renumeration with a purported $22.8M Wages and Benefits expense. This will be explained in red flag #4.

For several years, the Schedule of Renumeration and Expenses - 6(2)(d) Payroll Reconciliation to Financial Statement on RDCK’s SOFI is inaccurate.

Red Flag #4 – Inconsistent Reconciliating Items Starting 2014

In red flag#3, I showed that the sum of reconciling items was negative. Here are the details.

Starting from the third column, Total Reconciling Items of column D are broken down.

Starting in 2014 negative amounts start appearing in the reconciliating items, notably negative staff expenses and negative wage payable.

Starting in 2015, there’s a massive $2.5M in staff expenses and negative amounts for elected officials, Employer Share of Benefits is no longer part of the reconciliation.

Starting in 2016 to 2021, we see negative total reconciling items, negative overtime earnings, negative elected officials, negative taxable benefits,

2022 is a massive head scratcher. Total reconciling items is a whopping $5.15M comprised of $1.4M in staff expenses and $3.75M in Benefits Paid to Third Party. Notice the use of singular “Third Party”. One entity received $3.75M in relation to payroll.

For the above reasons, it looks like either the RDCK’s financial statements, or the RDCK’s SOFIs, or both are inaccurate. The potentially injured parties are the property owners, residents of the RDCK, the BC Government, the Municipal Financial Authority, and any other party relying on the financial reporting of the RDCK.

Conclusion

The RDCK is a profiteering runaway gravy train that enriches itself without any regards to property owners. With consistent poorly budgeted expenses driving taxation and user fees, the RDCK is eroding residents living standards. The RDCK and a web of needless contracted services are treating property owners like ATM machines. I find that highly disrespectful, offensive, and reprehensible.

Assuming the RDCK’s board members are also residents and property owners, they have not been acting in their own best interests. How could they let that mismanagement happen for so many years? The board appears to be on autopilot and at the mercy of financial managers taking advantage of their information asymmetry.

With yearly budget surplus inflated by omitting to budget for large expenses, managers and the board may be deceived into thinking that there’s plenty of money to spend. There’s no incentive to do more with less, which is driving payroll issues.

Solutions

To reduce the inherent moral hazard posed by RDCK’s financial managers, the board should hire a financially literate aide to help formulate questions to hold RDCK’s financial managers accountable and propose remedies.

Either the board of the RDCK wakes up and takes swift action, or the residents will have to take over the board, and then overhaul financial management.

The board should pass budget financial by-laws to:

Put a cap on expenses,

Peg or tie the budget constraints to macro-economic conditions of the RDCK

Put an end to the non-sense that public employers pay more for employment services than private sector: Freeze public wages until the corresponding private sector wages catches up.

Enforce a rigorous and strict budget variance analysis,

on a forward-looking 5 to 7 years basis, maintain a cash growth capped with inflation by freezing or even decreasing taxes and user fees,

Prioritize services and cut accordingly,

Create appropriate management incentives to achieve cost cutting, measure and maintain financial discipline (very low budget variance)

Create a web portal where a property owner can see the full granular attribution of his tax bill per service and vote on each service to keep or to discontinue. This would be an instant and on-going survey of service demand and a dynamic tool providing guidance to the board and to the CAO as to what kind of service to provide and capital expenditures to pursue.

Provincial Political Solution

Regional districts borrow money on behalf of their municipalities from the Municipal Finance Authority (MFA). A solution to the problem of mismanagement of the regional districts and local governments would be to enforce the above solutions via the debt financing of the regional districts; The MFA could impose the above solutions as conditions for financing. This would cut the funding of inadequate budgeting that impoverishes residents.

Who would have thought that a financial analysis could be such a page-turner! Thank you Lex