BCNU’s Customer Concentration: The BC Government

When I review the financial statements of a publicly listed company, I pay attention to changes in the disclosures of customer and supplier concentration because that determines pricing power and influence on the decision making of a company’s executives; A myriad of small and isolated customers is of little consequence when they individually complain because they are typically unaware that the product sold, or service rendered is fundamentally defective. When they wake up and connect, then class action lawsuits happen. But a large customer that represents 40%+ of revenues has tremendous influence on the direction of goods and services provided by the company.

BCNU, being a non-profit organization, follows different financial reporting standards than publicly listed companies which changes the presentation of revenues and that’s, in-and-of-itself, appropriate. But the principle that concentration of customer (sources of revenues) influence decision making still applies.

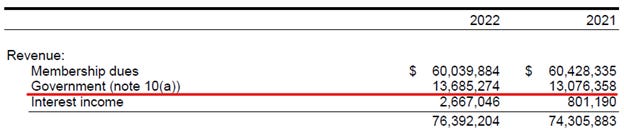

In 2022, the revenues of BCNU looked like this:

Above, Membership Dues are revenues from the 46000+ nurse members, Interest Income comes from short-term investments, and Government revenues are the fraction of the contributions from the Province of BC restricted for specific purposes that have been used has intended. Later below, I’ll show that the bulk of the BC Government contributions are flawed with an absence of a demonstrable and stable purpose.

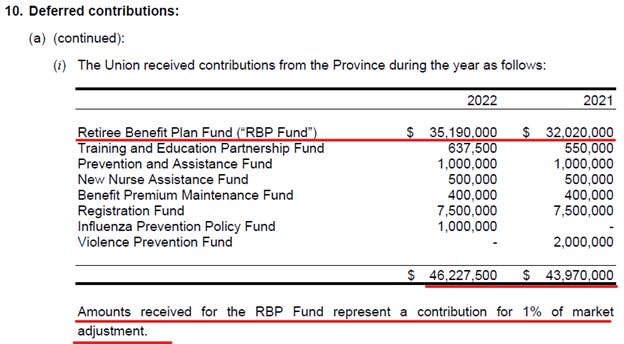

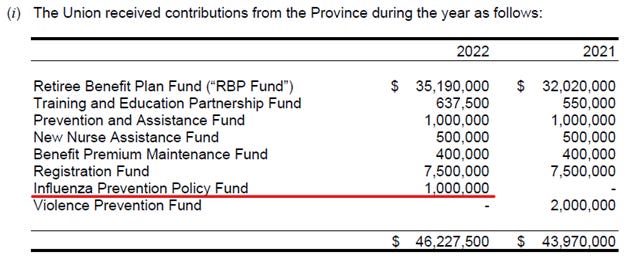

Arising from the collective historical agreements, the Province of BC has agreed to pay for various purposes to help and support the nurses. You’ll see these purposes in the deferred contributions below.

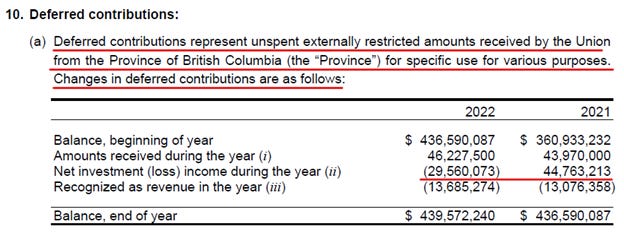

Here’s how they look like from the 2022 financial statements of BCNU:

BCNU received $46.2M and $44M from the Province, used only $13.7M and $13.1M in 2022 and 2021 respectively. So, there’s an excess of unused provincial contributions of $32.5M and $30.9M intended for the nurses that is accumulating in the coffer of BCNU in 2022 and 2021 respectively.

If BCNU was able to appropriately use all the money the BC government intended to give to the nurses via the collective agreement, its revenues would look like this:

This is a quantification of the financial influence that the BC Government has on BCNU, one of the largest unions in Canada.

The Unused Retiree Benefit Plan (RBP) Fund

Every year, the BC Government contributes 1% of nurses’ wages to a Retiree Benefit Plan (RBP) Fund managed by BCNU. BCNU received, from the Province of BC, $35.19M and $32.02M in 2022 and 2021 respectively, for the Retiree Benefit Plan Fund, as underlined above in the deferred contributions.

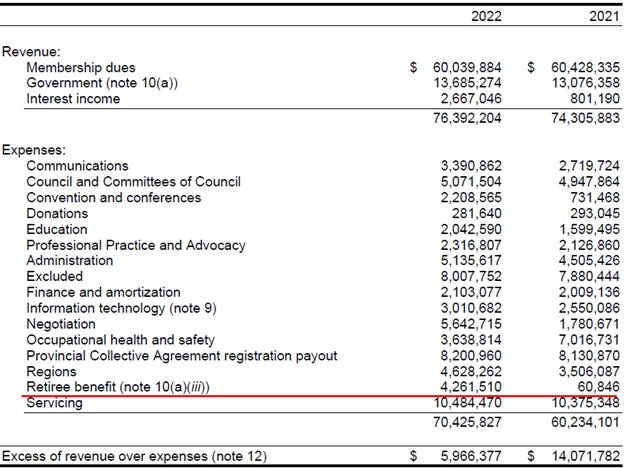

Next, from BCNU’s Consolidated Statement of Operations, let’s see how much of that money BCNU has used.

BCNU used only $4.26M and $60K in 2022 and 2021 respectively of the $35.19M and $32.02M RBP contributions received from the Province of BC in 2022 and 2021. It looks like there’s a problem with the intended purpose of the RBP Fund. BCNU is receiving an excessive amount of money for the use that it makes of it. It sure looks like provincial public funds are accumulating at BCNU. This has been going for years, here’s a summary of the last 5 years:

Next, I’ll answer the question: How much public funds, not used for their intended purposes1, have been accumulating at BCNU.

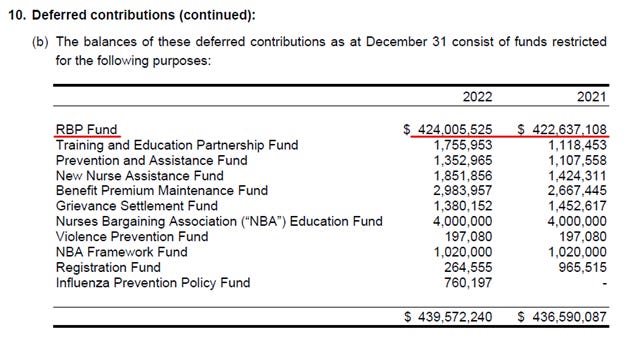

As of 2022, the RBP Fund stands at $424M and represents 96.5% of the BC Government accumulated contributions to BCNU. The other deferred contributions represent 3.5% of the BC Government’s contribution going into BCNU and are also deserving of scrutiny. The total of $439.6M accumulated and unused contributions to BCNU arise from the collective agreements over the last 10+ years…

On an asset basis, the $439.6M, contributed to BCNU by the Province, represents 76.5% of BCNU’s total assets; this, effectively makes BCNU more of an asset management operation than a non-profit labour organization whose operations should be exclusively for the economic well-being of its members or civic improvement. The RBP Fund is about the size of the BC fast ferries scandal.

The RBP Fund generates investment income (loss) during the year. Here what it looks like:

The massive $424M RBP Fund generated Net Investment (loss) income of -$29.6M and $44.8M in 2022 and 2021 respectively.

The Math - Tying Up the Fund Accounting Together

As a recap: In 2022:

1. the beginning balance of the RBP was exactly $422,637,108 (Dec 31st, 2021), (A)

2. the Province contributed exactly $35,190,000, (B)

3. the RBP had an investment gain or loss of -$29,560,073, (C)

4. BCNU expensed $4,261,510, (D) and

5. The RBP had an ending balance of $424,005,525 (E)

Note that we have an exact mathematical relationship (A) + (B) + (C) - (D) = (E); $422,637,108 + $35,190,000 + (-$29,560,073) - $4,261,510 = $424,005,525

I will now extend this analysis to the last five years (2018-2022) and summarize it in the following table:

Is the Retiree Benefit Plan (RBP) a Fraud?

The details of the RBP can be found on BCNU’s Retiree Benefit Program FAQ2 and the full details here3.

The RBP has been restated multiple times since its beginning:

· EFFECTIVE JANUARY 1, 2011

· ADOPTED AUGUST 16, 2011

· RESTATED APRIL 15, 2013

· RESTATED SEPTEMBER 8, 2015

· RESTATED JANUARY 1, 2019

· RESTATED NOVEMBER 1, 2022

· RESTATED JUNE 26, 2023

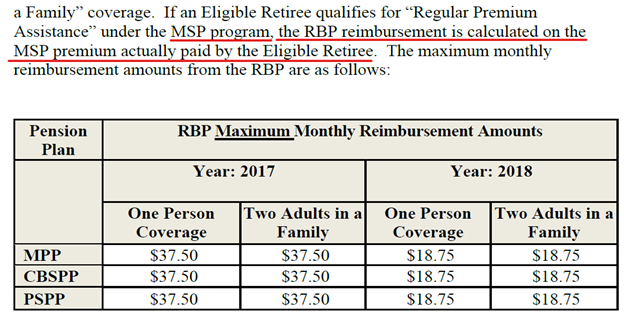

With so many restatements, the true intentions and purpose of the RBP are dubious at best. As of the last restatement of the RBP on June 26th, 2023, the benefits are described in Schedule “A”. Let’s have a look at those benefits:

The MSP premiums were eliminated on January 1st 20204; The benefits above are in the last effective RBP of June 26th, 2023; Clearly, the RBP and its $424M has no purpose.

Who Really Owns That $424M?

The RBP contributions are held in a special account.5 Who owns that account? Who are the main beneficiaries of that account? Is the $424M RBP Fund owned by BCNU’s members? By BCNU? Or by the Government of BC?

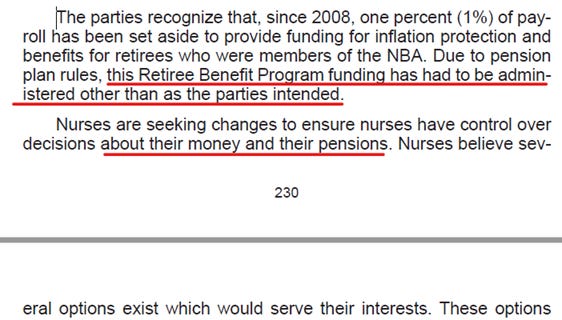

The NBA Retiree Benefit Program documentation states: “RBP and the RBP Fund are not intended to constitute or create a trust. Other than the disbursement of benefits from the RBP Fund to Eligible Retirees described herein, the Recipients and future Eligible Retirees have no right, title or interest in or to the assets of the RBP Fund ”6 This suggests that BCNU’s retired or active members don’t have ownership, which is also supported by the fact that the RBP hasn’t been substantially disbursed to BCNU’s members. The 2019 collective agreement7 discusses the RBP fund and refers to it has “their money”:

A trust relationship between BCNU and the BC Government could still be recognized because BCNU accounts for the RBP as externally restricted assets. That would bring up BC Financial Administration Act issues of duly accounting for public funds, and/or possessing public money applicable for a purpose and not applying that purpose.8

If BCNU is the owner, then the unused RBP contributions are part of BCNU’s income which has nothing to do with its stated operations description: “The British Columbia Nurses’ Union (the “Union”) was established to promote and protect the socio-economic well-being of its members and their communities. The Union is certified under the Labour Relations Code and is exempt from income taxes under the Income Tax Act.” In that case, BCNU may have a huge tax problem. Pension administration and retiree benefit administration activities are tax-exempt for non-profit organization under section 149(1)(o) of the Canada Income Tax Act. BCNU and the NBA (Nurses’ Bargaining Association) are tax-exempt non-profit organizations under a different section: 149(1)(k) – Labour Organization. Since there’s no clear and effective purpose to the RBF, the yearly unused and purposeless BC Government contributions to the RBP Fund may be regarded as part of BCNU’s net revenues over expenses (income).

Also, this would give strong legs to a BC Labour Relations Code challenge under section 6(1) – Unfair Labour Practice9: “An employer or a person acting on behalf of an employer must not participate in or interfere with the formation, selection or administration of a trade union or contribute financial or other support to it.” In the case where BCNU owns the RBP, then the BC Government is financially contributing to BCNU and as an agent of the health employers, that would be unlawful.

From the BC Labour Relations Code, an Unfair Labour Practice violation would be somewhat of a predicate to a section 12(1) violation: Duty of Fair Representation10: “A trade union or council of trade unions must not act in a manner that is arbitrary, discriminatory or in bad faith…”. Bad Faith happens when a union is acting with other motives than the exclusive socio-economic well-being of all its members; Discrimination and arbitrariness are co-morbidities of Bad Faith.

The RBP has entrapped both BCNU and the BC Government; They have to come clean or massively resign.

Dubious Motives for the RBP Disbursement of $4M in 2022

BCNU is certainly aware that receiving and accumulating public funds to the tune of $424M over more than 10 years is a problem. BCNU’s solution was to cook up a purpose by issuing a one-time payment of $500 to more than 8100 retirees totaling more than $4M.11 I don’t believe that this one-time $500 payment was intended for inflation protection of BCNU’s retired members. Inflation protection is a complex topic requiring significant economic and macro analysis. A carefully designed and credible inflation protection payment would be specific to and a function of individual retiree’s pension characteristics and would vary from retirees.

MSP was the last known purpose of the RBF. Since January 1st, 2020, the RBP is without any purpose. The $500 payment to each enrolled retiree, doesn’t answer the question: “What would be an adequate, fair and equitable amount to offset the loss of purchasing power of retired nurses since MSP was cancelled on January 1st, 2020?”; $500 payment to offset 3 years of inflation ($166.67/year, or $13.89/month) is not serious, it’s even less than a welfare payment. Given the size of the RBP, that’s offensive and insulting to BCNU’s retired members.

Instead, the $500 most likely originates from the requirements to issue a T4A slip. For pension purposes, T4A slips are required for payments of more than $500.12 The $500 payment is about form and appearances, not a genuine concern for substantial inflation affecting the retired nurses. BCNU hasn’t adequately addressed the problem that it is receiving an egregious amount of money, yearly. The RBP received, from the Province, $35M in 2022.

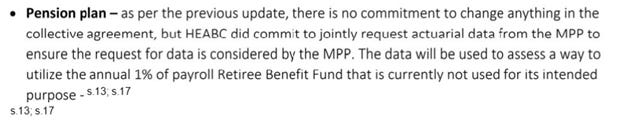

Who Else Knows About This Freak Show?

BC Health Minister Adrian Dix and Evan Howatson, Executive Director Labour & Agreements know about the RBP problems since at least Nov 2018. This is documented in BC FOI request answer HTH-2020-04783 on p.91, 93, 110, and 111.13 It looks like this:

The RBP Hole Will Get Deeper in 2024

To add insult to injury, the recent 2023 BCNU “tentative” collective agreement will include the wages of LPNs14, to the RBP Fund that has no credible purpose.

It Gets Worse: $100M One-Time Payment to BCNU

The 2023 recent “tentative” collective agreement between Nurses’ Bargaining Association (NBA) and the BC Government provides for a one-time payment of $100M for:

· Career Laddering,

· Nurse Support Fund,

· Nurse-to-patient ratio Initiative, and

· Marketing and Recruiting campaigns.

“The BC Nurses’ Union (BCNU) will administer the fund and assume all administrative costs associated with it.”15 This is going to be another entry in the deferred contributions shown above.

I don’t believe that BCNU and the BC Government have a credible plan to spend that $100M. These purposes are aspirational at best and for appearances.

I think that the real purpose of that $100M one-time payment is to keep BCNU silent on the damages caused by the PHO to the BC Healthcare system (9.7% of nurses were terminated) and to BCNU’s massive loss of stewards16, or other questionable purposes. The BC Government and BCNU are way too cozy in their relationship.

Conclusion

The lawfulness of the RBP is questionable. The balance of the RBP Fund is inappropriate for its past, current, and future purposes. The RBP has no well-defined, stable, and credible purpose. Over the last 10+ years, BCNU has strayed away from its core mandate by engaging in retiree benefit administration and investment management activities.

The BC Government financial contributions to BCNU are nothing less than the financial capture of BCNU, one of the largest union in Canada, by the province BC. The BC Labour Relations Code section 6(1) states: “An employer or a person acting on behalf of an employer must not participate in or interfere with the formation, selection or administration of a trade union or contribute financial or other support to it.”

Example #1 of Financial Capture: “Influenza Prevention Policy Fund”

Historically, BCNU’s position was neutral to the merit of influenza vaccination and left it up to the nurses to decide.17 In 2014 BCNU stated: “BCNU believes that … nurses and other healthcare workers should have the right to decide whether to be vaccinated against influenza, based on their understanding of the current evidence and in discussion with their own family physician or other care provider”.

A new “Influenza Prevention Policy fund” appeared in BCNU’s 2022 financial statements. The BC Government contributed $1M to BCNU for that purpose.

At the end of 2022, the balance left was $760,197 and BCNU spent only $239,803; This tells us that nurses are fundamentally not interested in the influenza vaccine.

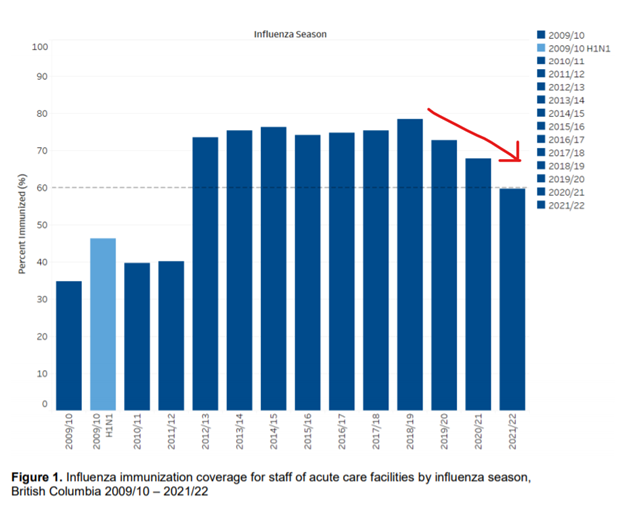

I haven’t found any mention of “Influenza Prevention Policy” in the recent tentative agreement18, yet it shows up in the 2022 financial statements of BCNU; I wonder if that $1M contribution is even lawful. More disturbing, “Influenza Prevention Policy” is an employer policy that started in 2012/201319:

The reason why BCNU is now pushing the employer’s Influenza Prevention Policy is because the Health Care Workers coerced habituation to influenza vaccination is plummeting. This habituation originated from the vax-or-mask Influenza mandate of 2012/2013, and trust in the reasonableness of the policy is disappearing fast. Health care workers are becoming immune to public health policy quackery and that’s a good thing. From the years before 2013, in the absence of coercion, at least 60% of health care workers did not see influenza vaccines as beneficial. It is quackery and whoever promotes and coerces people in taking ineffective medical treatments is a dangerous quack.

Example #2 of Financial Capture: HEABC tolerates BCNU’s Unreliable Financial Reporting Practices

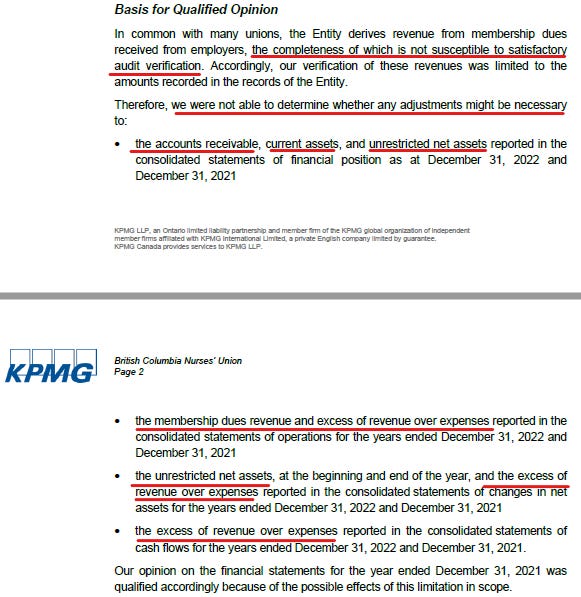

For at least the last 5 years, BCNU received what I would consider a severe qualified independent audit opinion from its auditors KPMG. In the 2021/2022 Auditor General’s Report on the financial audit work for BC20, Michael Pickup, BC General Auditor, explains what a qualified audit opinion is: “A qualified Independent Auditor’s Report is unusual and should not be taken lightly. When auditors issue a report with qualifications, they are usually warning the users that some of the information in the financial statements is inaccurate. Material misstatements like the ones identified in this report, represent errors or omissions the auditor considers so significant that mislead a user in their interpretation of the financial statements...”

This is the Basis for Qualified Opinion that BCNU received over the last 5 years from KPMG:

If I’d be an employer negotiating in good faith and willing to make concessions aligned and in spirit with the duties of the BC Labour Relations Code, I would require my trading counterparty to be transparent and accountable to the monies that I have already conceded in the past so. HEABC not forcing BCNU to clean up its accounting and obtain a clean unqualified audit opinion from its auditor, KPMG, is symptomatic that they are in cahoots and are not negotiating in good faith. The dismal auditor opinion that BCNU keeps getting for at least the last 5 years should have been addressed. It is not acceptable.

Bad Faith

The Nurses’ Bargaining Association (NBA), its member BCNU, and the BC Government are too close. They can no longer be presumed to be acting of good faith. The Canada Income Tax Act, the BC Financial Administration Act, or the BC Labour Relations Code may have been violated over a very long period. This has been going on for more than 10 years over multiple collective agreements. BCNU appears to have other motives than the exclusive socio-economic well-being of its members. This brings up a very important topic: Covid-19 vaccine mandate terminated nurses.21

Industry-Wide Application Dispute (IWAD)

In December 2022, BCNU submitted an Industry-Wide Application Dispute against mandatory Covid-19 vaccination Policies.22 An IWAD is a mechanism where similar grievances are arbitrated together. Whoever arbitrates this IWAD is at risk of being manipulated into an arbitration decision that will serve political purposes rather than the economic well-being of BCNU’s member and the fulfilling of the duties of the BC Labour Relations code.

BCNU and HEABC (Health Employers Association of BC) have mutually agreed to appoint Arbitrator Jackie de Aguayo. Hearing dates have been set for March 20-22 and 25-28, 2024. Some preliminary issues raised by Health Employers will be addressed at case management meetings over this summer.

Given that the Province and BCNU are too close, I had to wonder why Jackie de Aguayo was chosen; Up until Feb 4th, 2022, she was the chair of the BC Labour Relations Board.23 Jackie de Aguayo earned a salary of $229,21324 and $234,59725 as Chair Labour Relations Board in fiscal year ending March 2021 and March 2022 respectively. Less than a year after concluding her labour board chair appointment, she’s picked to arbitrate the BCNU Covid-19 vaccine terminations. The fix is in.

We are 2 of the thousands of nurses fired in BC over vaccine mandates. The BCNU did nothing to support my husband and I.... just words and pointless meetings meant to intimidate. While nurses who stole narcotics or caused critical incidents were protected and returned to work, we were discarded for "misconduct". I have 23 years nursing experience and 15 years in Vancouver on a specialty critical care unit. My husband was an emerg psychiatry nurse in Vancoiver and on Van Island with 10 years experience and many awards for care. We lost our careers, our home, all of our hard work and our life savings as Canadian immigrants. We were once so proud to get our Canadian citizenship but when we were fired for not taking part in the covid vaccine clinic trial, we tucked tail and fled with our children back to the US to live with our parents. The VGH solid organ transplant unit fired their educator with 28 years experience. The units my husband worked caring for the mentally ill have been closed. BC used to be an amazing place but this article details how a once great profession and province and country have fallen to evil, ugly Maoist Marxist agendas of the WEF. I am so so sad at all that we have lost.

Not surprised.... take a look here...right from the horse's mouth.... https://gettr.com/post/p1va6ik5a79